How Much Does It Cost to Raise a Child in the UK, Raising a child is one of the most fulfilling experiences a person can have, but it also comes with its fair share of financial responsibilities. In the UK, the cost of raising a child has been a topic of much discussion among parents, financial experts, and policymakers. Understanding these costs is crucial for planning and ensuring that you can provide the best for your child from birth through to adulthood. This article delves into the various expenses involved and offers insights into how you can manage these financial challenges effectively.

Understanding the Costs

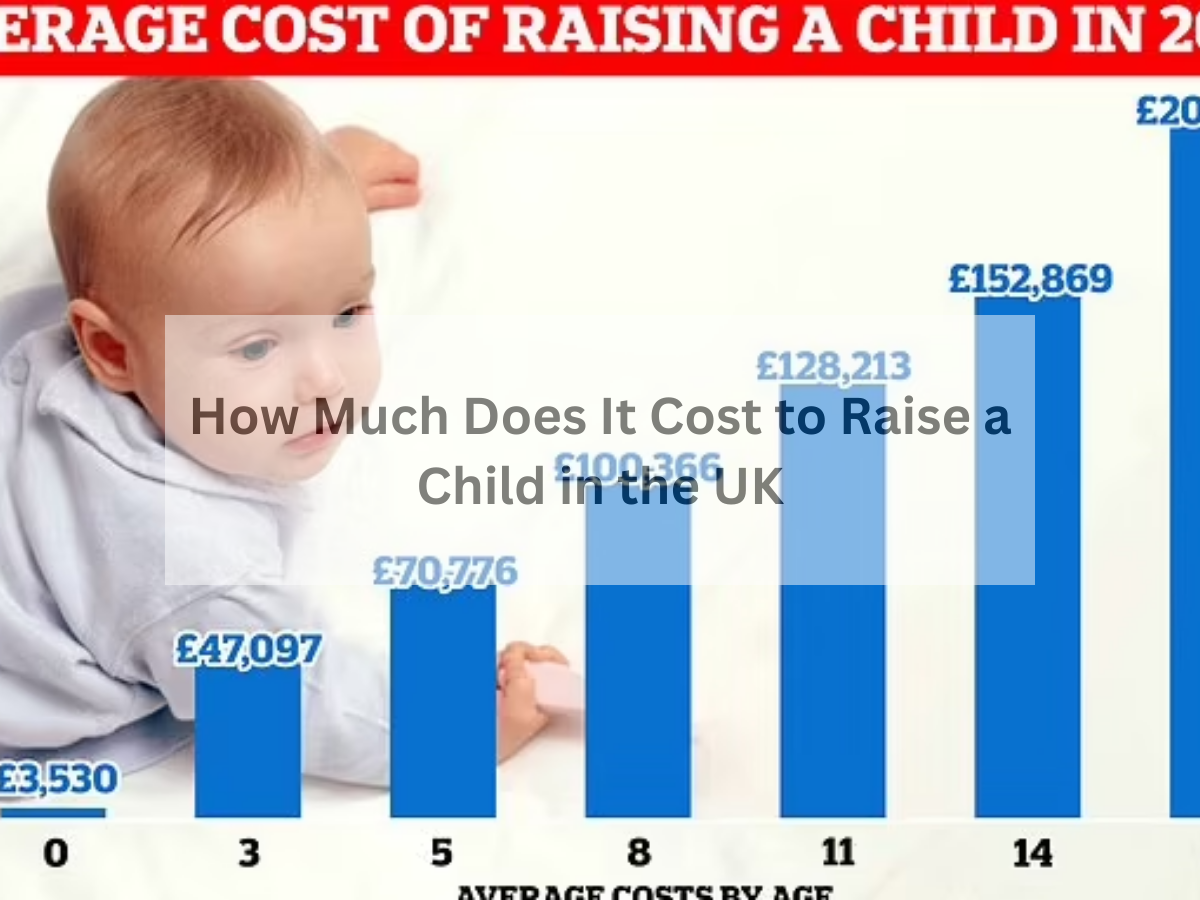

The cost of raising a child in the UK can vary significantly depending on various factors, including location, lifestyle choices, and the level of education you wish for your child. According to recent studies, the average cost of raising a child until the age of 18 is estimated to be in the region of £150,000 to £200,000. This figure encompasses a wide range of expenses, from basic needs like food and clothing to more substantial costs such as housing, childcare, and education. For more detailed insights and tips on managing these expenses, visit “How Much Does It Cost to Raise a Child?”, which offers valuable information and resources for financial planning.

Housing and Living Expenses

Housing is often the most significant expense for most families. The cost of providing a home for a child includes not only rent or mortgage payments but also utility bills, council tax, and maintenance costs. Living expenses, meanwhile, cover everything from food and clothing to healthcare and transportation. It’s essential to budget carefully for these ongoing costs, bearing in mind that they are likely to increase as your child grows.

Childcare and Education

Childcare costs can be particularly steep in the UK, especially for younger children. Many families find themselves allocating a substantial portion of their income to nursery fees or childminder costs. As children grow, education becomes a major expense. While state education is free, any additional costs such as uniforms, school trips, and extracurricular activities can add up. For families opting for private education, the expenses are significantly higher, often running into thousands of pounds per year.

Healthcare and Miscellaneous Expenses

While the UK’s National Health Service (NHS) provides healthcare at no direct cost, there are still some health-related expenses to consider, such as dental care, eye care, and any private healthcare services. Miscellaneous expenses can also accumulate, from birthday parties and holiday gifts to sports equipment and leisure activities. These costs may seem minor individually, but together, they contribute significantly to the overall cost of raising a child.

Planning and Managing Costs

Effective financial planning is key to managing the costs of raising a child. This includes creating a detailed budget, setting aside savings for future education expenses, and exploring options for reducing costs, such as taking advantage of government benefits and tax credits.

Conclusion

Raising a child in the UK is undeniably expensive, but with careful planning and management, it is possible to navigate the financial challenges it presents. By understanding the various costs involved and exploring ways to optimize your spending and savings, you can ensure that you provide a stable and nurturing environment for your child to grow. Remember, investing in your child’s future starts with making informed financial decisions today.

Cycling training tips and camps with Joel Chavez, Pan-American Gold Medalist has been writing about savings and finance since 2016 and analyzes thousands of products to find you the best deal. He will help you save money while you shop. They cover huge products including home, garden, car, business, tech, and many more for making the best financial decision.